There are a lot of different risks you have to watch for in your own business, there are many types of risks in investment too. When you’re starting your own business, you’ll have a lot of things to worry about, but the risk of your investment isn’t one of them. While This blog will look at the most common types of investment risks and how to avoid them.

What Types Of Risks In Investment?

There are many types of investment risk, and every kind of risk has the potential to impact investments in different ways. Some of the more common types of investment risk include market risk, credit risk, interest rate risk, and liquidity risk.

- Market risk is the risk that the value of an investment will fluctuate due to changes in the overall market. This type of risk is often difficult to predict and can significantly impact the value of an investment.

- Credit risk is the risk that a borrower will default on a loan.

- Interest rate risk is the risk that the value of an investment will fluctuate due to changes in interest rates.

- Liquidity risk is the risk that an investment will be challenging to sell at a fair price.

Systematic Risk Vs. Unsystematic Risk

When it comes to risk, there are two main types: systematic and unsystematic.

Systematic Risk

Systematic risk is defined as the risk that is inherent to the entire market or economy. This type of risk is often beyond the control of individual investors and companies.

Systematic risk is often considered the more severe type of risk, as it can significantly impact an entire market or economy. This type of risk is often beyond the control of individual investors and companies. Beta can help understand this.

Unsystematic Risk

On the other hand, unsystematic risk is specific to a particular security or industry. This type of risk can often be mitigated through diversification. Unsystematic risk, while potentially damaging, is typically more localized and thus may be easier to manage.

Market Risk

Market risk is the risk of loss resulting from fluctuations in the prices of assets in the financial markets. The risk is that the value of a security, portfolio, or index will decrease due to market conditions. Market risk is also known as price risk or equity risk.

Currency Risk

Currency risk is the risk that the value of a currency will change, potentially adversely affecting the return on investment. For example, if an investor buys a foreign stock denominated in a currency that subsequently weakens, the value of the investment may decline even if the stock performs well.

There are several ways to hedge against currency risk, including investing in currency-hedged mutual funds or exchange-traded funds, using currency forwards or binary options, or investing in foreign stocks denominated in stronger currencies.

Investors should be aware of currency risk when making investment decisions, as it can significantly impact returns. By understanding how to hedge against currency risk, investors can help protect their portfolios from potential losses.

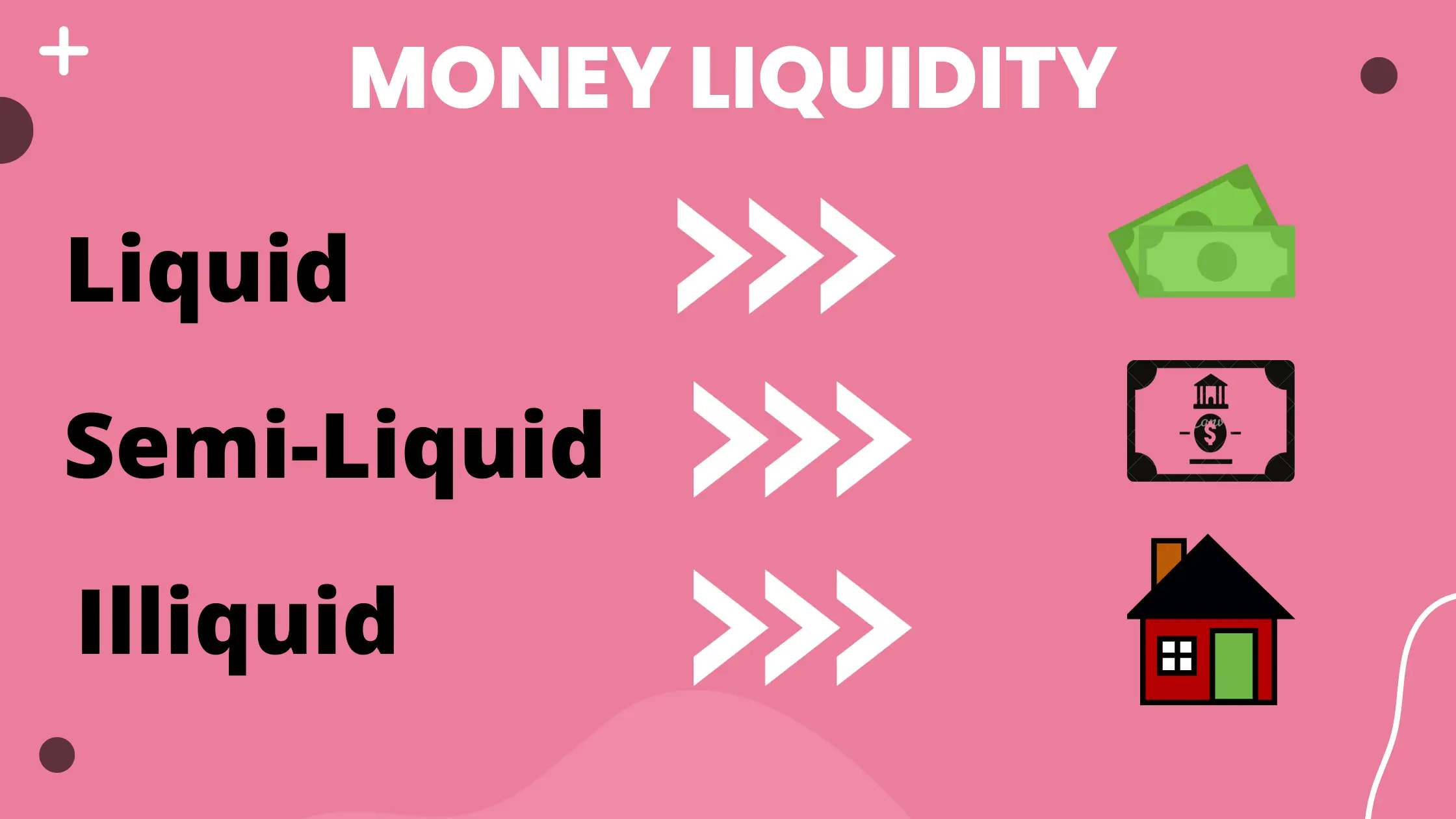

Liquidity Risk

Liquidity risk investment refers to an investment strategy that seeks to minimize the risk of loss due to a lack of liquidity. Liquidity risk is the risk that an investor will not be able to sell an asset at a fair price or that the investment will not be able to be sold at all. Many investors seek to avoid liquidity risk by investing in highly liquid assets, such as cash, government bonds, and blue chip stocks.

Concentration Risk

Concentration risk is the risk that an investment will lose value because it is concentrated in a particular asset, sector, or region. This risk is often difficult to diversify away and can lead to significant losses if the investment, sector, or region experiences a sudden decline in value. For this reason, investors concerned about concentration risk may choose to limit their exposure to any asset, sector, or region.

Credit Risk

Credit risk investment is the process of investing in securities that are exposed to the risk of default. Hedge funds and other institutional investors typically make this investment. The goal of credit risk investing is to generate returns that are not correlated with the broader market.

Reinvestment Risk

Reinvestment risk refers to the chance that an investment’s cash flows will not be sufficient to fund principal and interest payments reinvestment when they come due. This can happen when interest rates rise, making it more expensive to reinvest in new projects, or when the underlying investment declines in value.

Reinvestment risk is a significant concern for many investments, especially those with long-term horizons. For example, an investor in a 30-year bond will be exposed to reinvestment risk for the entire term of the bond.

This risk can be mitigated by laddering bonds with different maturities or investing in shorter-term bonds and rolling them over as they mature.

Investors should be aware of the reinvestment risk associated with their investments and factor it into their overall risk tolerance.

Inflation Risk

Inflation risk is the risk that an investment will lose value due to inflation. This real risk must be considered when making any investment, especially long-term investments.

Many factors can contribute to inflation, including economic growth, government policy, and the actions of central banks. While there is no guaranteed way to avoid inflation risk, diversifying one’s investments may help to mitigate it.

Horizon Risk

Many different types of risk need to be considered when making investment decisions. One type of risk that is often overlooked is horizon risk. Horizon risk is the risk that an investment will not reach its full potential due to unforeseen circumstances.

For example, if you invest in a new company that is expected to multiply, there is a risk that the company will not be able to meet its growth targets due to unforeseen circumstances. This type of risk can often be difficult to predict and can significantly impact an investment’s performance.

Horizon risk is just one type of risk that needs to be considered when making investment decisions. However, it is essential to remember that all types of risk need to be managed to achieve success in the long term.

Longevity Risk

Longevity risk is the risk of outliving one’s savings. It is a significant concern for retirees, who may have to support themselves for many years in retirement. Several ways to manage longevity risk include annuities and longevity insurance.

Annuities provide a guaranteed income for life, which can help retirees have the resources they need to support themselves. Longevity insurance provides a death benefit that can help cover long-term care costs. Both options can help manage longevity risk and provide peace of mind in retirement.

Foreign Investment Risk

The globalization of business has led to an increase in foreign investment. While foreign investment can bring new capital and jobs to a country, it also risks. The most significant risk is that a foreign company may be less committed to the long-term success of a project in a foreign country than a domestic company would be.

This can lead to a lack of investment in critical areas, such as training, research, and development, which can ultimately impact the project’s competitiveness. Additionally, foreign companies may be less responsive to local community concerns and more likely to exploit natural resources without regard for environmental sustainability.

Thus, while foreign investment can be a boon to a country’s economy, it is essential to consider the risks before welcoming it with open arms carefully.

Interest Rate Risk

Interest rates constantly fluctuate, which can create significant risks for investors. When interest rates rise, the value of fixed-income securities falls, and vice versa. This risk is known as interest rate risk.

Investing in short-term securities is often the best strategy for investors in search of stability. Short-term securities are less sensitive to changes in interest rates and therefore tend to be less risky.

Of course, no investment is entirely risk-free. But investors can help protect their portfolios from potential losses by understanding and managing interest rate risk.

Country Risk

There are many factors to consider when making investment decisions, one of which is country risk. This is the risk that a country will experience political or economic instability that could negatively impact investments.

There are several ways to measure country risk, and each investor will have their method. Factors like a country’s political stability, economic indicators, and monetary policy also matter.

Investors must weigh the potential rewards of investing in a high-risk country against the potential losses. They also need to consider how much risk they are comfortable with and whether they have the stomach for volatile markets.

Country risk is just one factor to consider when making investment decisions, but it is essential. Those willing to take on more risk may be rewarded with higher returns, but they must be aware of the potential risks involved.

Exchange Rate Risk

When investing in foreign markets, it’s essential to be aware of the potential for exchange rate risk. This risk arises when the value of the currency you’ve invested changes relative to your home country’s currency. For example, if you invest in a company that does business in Europe and the euro weakens against the dollar, your investment will be worth less.

There are a few ways to mitigate exchange rate risk. One is to invest in companies with a diversified customer base that aren’t as reliant on any currency. Another is to use hedging techniques, such as currency forwards, to offset the risk.

Of course, you can also accept the risk and hope that your invested currency will appreciate against the dollar. This can be risky, but it can also pay off if your investment is successful.

Timing Risk

There are several factors to consider when deciding when to invest in a particular stock or other security. One of the most important is timing risk. The risk is that the security price will change, making the investment less profitable.

Timing risk can be challenging to predict as it depends on several factors, including the overall market conditions, the company’s financial health, and the political and economic conditions of the country or region where the company is based.

However, by researching and staying up-to-date on current conditions, you can minimize your exposure to timing risk and maximize your chances for a successful investment.

Volatility Risk

Volatility risk is the risk that the value of an investment will fluctuate over time. This type of risk is often associated with investments in the stock market, where prices can rise and fall rapidly. Volatility risk can also affect other assets, such as bonds and real estate.

Investors concerned about volatility risk may choose to invest in assets less likely to fluctuate in value, such as government bonds. They may also diversify their portfolios by investing in various assets, which can help offset the risk of any one investment losing value.

While volatility risk can be a concern for investors, it is also important to remember that fluctuations in the value of investments are normal and can present opportunities to buy assets at a lower price.

Over time, the value of most investments will tend to rise, so volatility risk should be considered in the context of the overall investment strategy.

Political Risk or Government Risk or Regulator Risk

Many different types of risks can affect investments, and political risk is one of the most important to consider. Political risk can refer to the risk of a change in government policy that could adversely affect the value of an investment or the risk of a country’s political instability affecting the value of investments made there.

In many cases, political risk is closely linked to government risk, which is the risk that a government will take actions that could negatively impact the value of an investment.

For example, suppose a country’s government imposes strict regulations on the banking sector. In that case, this could make it difficult for banks to operate profitably and reduce the value of investments in those banks.

Similarly, regulator risk is the risk that a country’s regulatory environment could change in a way that would adversely affect investments. For example, suppose a country’s securities regulator imposes stringent new rules on the stock market.

In that case, this could make it difficult for companies to list their shares and could reduce the value of investments in those companies.

Political risk, government risk, and regulator risk are all essential considerations for any investor. They should be taken into account when making any investment decision.

Valuation Risk

Valuation risk is the risk that the value of an asset or liability will change over time. This type of risk is often seen in investments, where the value of a security may fluctuate. Valuation risk can also apply to other assets, such as real estate or art. Changes in the value of these assets can impact a company’s or individual’s financial health.

There are a few ways to manage valuation risk. One is to diversify one’s investments so that a change in one asset’s value will not significantly impact the overall portfolio. Another approach is to use hedging strategies, such as buying put options, to protect against potential losses.

Valuation risk is an essential consideration for any investor or company. Understanding this risk and taking steps to mitigate it can help ensure a more stable financial future.

Business Risk & Technology Risk

Technology and business risks are essential factors to consider when making investment decisions. Technology risk includes the potential for new technologies to disrupt existing businesses, the pace of technological change, and the risks associated with investing in new and unproven technologies.

Business risk includes factors such as the financial stability of the company, the competitive landscape, and the company’s ability to execute its business plan.

Technology and business risk can be mitigated through careful research and due diligence. When making investment decisions, it is essential to consider both risks and potential rewards.

Diversifying one’s portfolio across several different companies and industries makes it possible to reduce overall risk while still achieving returns.

Execution Risk

Execution risk is the risk that a trade will not be executed as intended or that the execution will not meet the investor’s expectations. This can occur due to several factors, including market conditions, order size, price volatility, and security liquidity.

Execution risk is a primary consideration for all investors and can significantly impact investment performance.

There are many ways to mitigate execution risk, including using limit orders, stop-loss orders, and taking advantage of market conditions. Execution risk can also be managed using various trading strategies, such as market-making, scalping, and arbitrage.

Even though the inherent risk in all investing, execution risk can be managed with a thoughtful and disciplined approach; by understanding the factors that can lead to execution risk and taking steps to mitigate it, investors can minimize its impact on their portfolios.

Investment Risk Management And Points To Keep In Mind

- Always do your research before investing in anything. Understand what you’re investing in and the risks involved.

- Have a clear investment plan and goal in mind. Know how much you’re willing to invest and what you hope to achieve from your investment.

- Diversify your investments. Don’t put all your eggs in one basket. Consider investing in different asset classes to spread your risk.

- Consider the fees associated with investing. Some investment products come with high prices, which can affect your returns.

- Be aware of the tax implications of your investments. Different investments are taxed differently, and you should factor this into your planning.

- Have an emergency fund to cover unexpected expenses. This will help you avoid selling investments at a loss in a down market.

- Be patient. Don’t expect to get rich quickly. Investment success takes time and patience.

- Stay disciplined. Don’t let emotions guide your investment decisions. Stick to your investment plan.

- Review your investments regularly. This will help you stay on track and make sure your investments are still aligned with your goals.

- Seek professional advice if you’re not comfortable managing your investments. A financial advisor can help you develop and implement an investment plan right for you.

Conclusion

You have to consider four main types of risk when it comes to investments: business risk, market risk, liquidity risk, and interest rate risk. We hope you’ve found this blog post helpful in introducing you to the many different types of investment risks.

If you have any questions about this information, please don’t hesitate to contact us.

Greetings! Very useful advice within this article! It is the little changes that produce the most significant changes. Thanks for sharing!