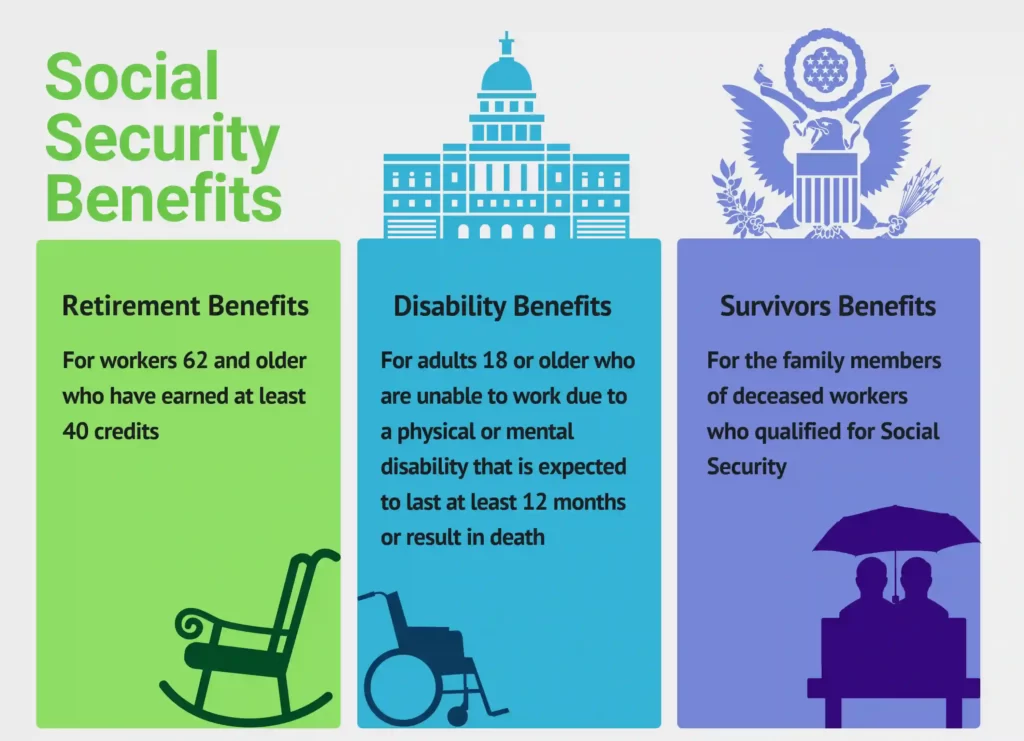

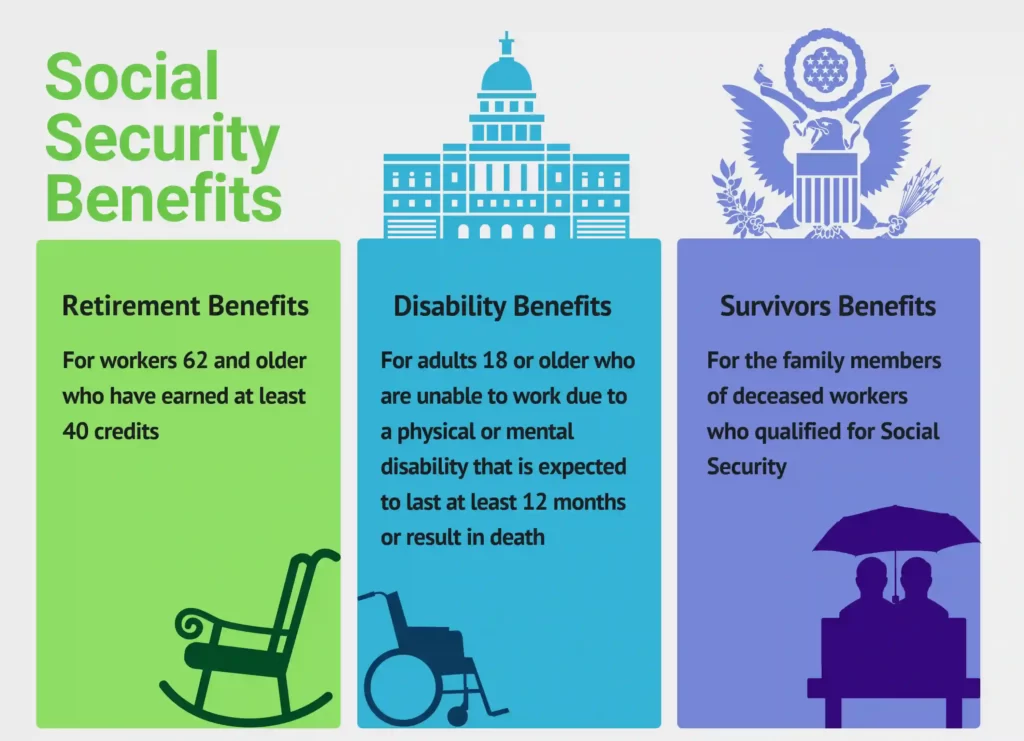

In this article, we focus on the maximum social security benefits. The Social Security Administration (SSA) is an agency of the United States government that administers Social Security, a social insurance program. Social security benefits are available to workers, their families, and some survivors.

Maximum social security benefits 2022

According to the Social Security Administration, the maximum social security benefits for 2022 will be $4,194 per month for those who retire at full retirement age. A certain percentage will reduce the benefits for those who retire early. A certain percentage will increase the benefits for those who retire late.

What is an Annual Social Security Cost-of-Living Adjustment (COLA)?

One of the fine features of Social Security advantages is that the authorities adjust the benefits each year primarily based on inflation. This is known as a value-of-dwelling adjustment, or COLA, and allows your bills hold up with increasing living prices.

The Social Security COLA is giant. It’s the equivalent of purchasing inflation protection on a non-public annuity, that may get luxurious.

Because the COLA is calculated based totally on changes in a federal purchaser fee index, the dimensions of the COLA depends largely on vast inflation ranges determined by means of the authorities (and they’re a bit special than those used in the monthly client price index followed through economists and others).

In 2022, Social Security beneficiaries saw a 5.9% COLA of their monthly Social Security benefits, the largest growth in view that 1982. The COLA for 2023 might be announced in mid-October.

Here’s what COLAs have been in other recent years:

- 2009: 5.8%

- 2010: 0%

- 2011: 0%

- 2012: 3.6%

- 2013: 1.7%

- 2014: 1.5%

- 2015: 1.7%

- 2016: 0%

- 2017: 0.3%

- 2018: 2%

- 2019: 2.8%

- 2020: 1.6%

- 2021: 1.3%

Maximum social security benefits at 67

As of 2020, the maximum social security benefit for those retiring at age 67 is $2,265 per month. This amount is based on the average lifetime earnings of the worker. For those with higher earnings, the benefit will be higher. The maximum social security benefit is adjusted for inflation each year.

Maximum social security benefits for a married couple

The maximum social security benefits for a married couple is currently $32,000 per year. This amount is based on the combined earnings of both spouses and is adjusted for inflation each year.

For couples who have reached full retirement age, the maximum benefit is $64,000 per year. These benefits can be very helpful in providing financial security in retirement.

Maximum social security benefits by age

The maximum social security benefits that an individual can receive depends on their age. For example, those 62 years old or older can receive the full social security benefits they are entitled to.

However, those younger than 62 years old can only receive a partial social security benefit. The amount of benefit an individual receives also depends on their earnings history.

| Average Social Security Benefit by Age | |

| Age | Average Monthly Benefit |

| 66 | $1,745.14 |

| 67 | $1,719.23 |

| 68 | $1,739.24 |

| 69 | $1,736.43 |

| 70 | $1,728.79 |

| 71 | $1,751.26 |

| 72 | $1,786.89 |

| 73 | $1,792.45 |

| 74 | $1,825.03 |

| 75 | $1,793.63 |

| 76 | $1,801.90 |

| 77 | $1,818.23 |

| 78 | $1,829.57 |

| 79 | $1,824.08 |

| 80 | $1,805.93 |

| 81 | $1,763.16 |

| 82 | $1,740.47 |

| 83 | $1,703.41 |

| 84 | $1,657.44 |

| 85 | $1,636.90 |

| 86 | $1,369.43 |

| 87 | $1,350.42 |

| 88 | $1,354.06 |

| 89 | $1,345.23 |

| 90 or older | $1,344.76 |

Maximum social security benefits born 1956

If you were born in 1956, you are eligible for the maximum social security benefits. This means that you will receive the highest possible monthly payments from the social security system.

To qualify for these benefits, you must have worked and paid for at least 40 years into the system. If you have not worked for that long, you may still be eligible for benefits, but they will be reduced.

Also Read: 21 amazing Q&A regarding Investment Banking

Maximum social security benefits 2019

The Social Security Administration has announced that the maximum social security benefits for 2019 will be $2,861 per month. This is an increase of $39 from the 2018 maximum of $2,822.

The maximum benefits are paid to those who have worked long enough and paid into the system. The amount of the benefit is based on the worker’s earnings history.

Maximum social security benefits taxable

The Social Security program is designed to provide financial security for American workers and their families. The program is financed through payroll taxes levied on workers’ wages. A portion of these taxes is deducted from workers’ paychecks, and their employers pay the remainder.

The Social Security program is funded by two trust funds, the Old-Age and Survivors Insurance (OASI) Trust Fund and the Disability Insurance (DI) Trust Fund. Workers’ payroll taxes are deposited into these trust funds. The funds are then used to pay benefits to eligible workers and their families.

The amount of Social Security benefits taxable depends on the total amount of income received from all sources. For example, suppose a worker’s only source of income is their Social Security benefits.

In that case, none of their benefits is taxable. However, suppose a worker also has income from other sources, such as wages from employment. In that case, a portion of their Social Security benefits may be taxable.

The maximum amount of Social Security benefits that are taxable is 85%. If a worker has income from other sources, up to 85% of their Social Security benefits may be included in their taxable income.

Maximum social security benefits at 65

Individuals who have paid into the social security system are eligible to receive benefits when they reach the age of 65. The benefit amount is based on the individual’s earnings history. It is calculated to provide a basic level of financial security in retirement.

The maximum social security benefit that an individual can receive is currently set at $2,788 per month. This amount is intended to cover the basic needs of a retired person, such as housing, food, and clothing. It is not designed to provide a comfortable lifestyle. Still, it can make a significant difference in the quality of life of a retiree.

The maximum social security benefit is subject to cost-of-living adjustments each year, gradually increasing over time. However, it is still important for retirees to plan for their financial future, as the maximum benefit may not be enough to cover all of their expenses.

Maximum social security benefits calculator

The maximum social security benefits calculator can help you estimate your potential social security benefits. This includes your retirement, disability, and survivor benefits. You will need to input your date of birth and current earnings to use the calculator. The calculator will then provide you with an estimate of your maximum social security benefits.

What is the age for maximum social security benefits?

There is no definitive answer to this question. It depends on several factors, including when you start receiving benefits and your overall earnings history. However, some general guidelines can provide some insight.

Generally speaking, you can start receiving social security benefits as early as age 62. However, if you start receiving benefits at this age, your benefits will be reduced by 30%. Therefore, you will receive your full benefit amount if you can wait until you reach full retirement age, between 66 and 67, depending on your year of birth.

Suppose you delay receiving benefits beyond your full retirement age. In that case, you will receive an additional 8% per year in benefits up to age 70. Therefore, if you wait until age 70 to receive benefits, you will receive the highest possible benefit amount.

Of course, these are just general guidelines, and your actual benefit amount will depend on your circumstances. Therefore, it’s best to speak with a social security representative to get a more accurate estimate of what you can expect to receive.

Minimum and maximum social security benefits

The United States Social Security Administration (SSA) sets the minimum and maximum social security benefits paid to eligible beneficiaries. The minimum social security benefit is $816 per month, while the maximum social security benefit is $3,678 per month.

The amount of social security benefits that a beneficiary receives is based on their lifetime earnings and the age at which they begin receiving benefits. Beneficiaries who start receiving benefits at age 62 will receive a lower monthly benefit than those who start receiving benefits at full retirement age (FRA), which is currently 66 years old.

The SSA adjusts the maximum social security benefit each year to keep pace with inflation.

How to qualify for maximum social security benefits?

The best way to qualify for maximum social security benefits is to have worked for at least 35 years and have earned a high income during that time. The more years you have worked and the higher your income, the higher your social security benefits.

You can also qualify for maximum social security benefits if you have worked for a long time but have not earned a high income. In this case, your benefits will be based on the number of years you have worked.

What age to get maximum social security benefits?

The age to get maximum social security benefits is 70. If you wait until 70 to start receiving benefits, you will get the highest possible monthly payment. If you start receiving benefits before 70, your payments will be lower.

When do you get maximum social security benefits?

The best age to start collecting social security benefits is 70. By waiting until 70, you’ll receive the highest possible benefit payments. Your benefits are calculated based on your average earnings over your lifetime. So, if you wait until 70 to start collecting, you’ll receive the highest possible benefit payments.

How do you calculate a family’s maximum social security benefits?

There are several ways to calculate a family’s maximum social security benefits. The most common way is to use the Social Security Administration’s online calculator. This calculator will consider the ages of the family members, the number of years each family member has worked, and the current wage rates.

Another way to calculate a family’s maximum social security benefits is to use the Social Security Administration’s worksheet. This worksheet can be found on the Social Security Administration’s website.

This worksheet will consider the ages of the family members, the number of years each family member has worked, the current wage rates, and the family’s total income.

The Social Security Administration’s website also has a calculator that can estimate a family’s maximum social security benefits.

This calculator is called the “Family Maximum Benefit Calculator.” This calculator will consider the ages of the family members, the number of years each family member has worked, the current wage rates, the family’s total income, and the number of family members.

Maximum social security benefits 2020

As of 2020, the maximum social security benefit is $2,788 per month. This amount is based on the average lifetime earnings of a worker who retires at age 65.

For workers who retire before age 65, the maximum benefit is reduced. The maximum social security benefit is taxable and is subject to the standard income tax rules.

The maximum amount of social security benefits

The amount of social security benefits that an individual can receive is determined by several factors, including their age, earnings history, and whether they are disabled. The maximum amount of social security benefits that an individual can receive is $2,788 per month.

The maximum tax on social security benefits

The maximum tax on social security benefits is 85%. This tax is imposed on individuals who have retired and receive social security benefits.

The tax is also imposed on individuals who are receiving disability benefits. The tax is imposed on the total amount of benefits an individual receives from the social security system.

Maximum earnings before social security benefits are reduced.

The Social Security Administration (SSA) has a special limit on the amount of money you can earn and still receive full social security benefits. This limit, known as the “maximum earnings before social security benefits are reduced,” is currently set at $3,000 per month.

If you earn more than this amount, your benefits will be reduced by $1 for every $2 you earn over the limit.

Maximum age for social security benefits

The Social Security Administration (SSA) has set the full retirement age at 66 for people born between 1943 and 1954. The full retirement age will gradually increase to 67 for people born in 1960 or later.

The SSA has also established early retirement age of 62. However, if you elect to take early retirement, your benefits will be reduced. The amount of the reduction depends on your date of birth. For example, if your full retirement age is 67 and you retire at age 62, your benefits will be reduced by 30%.

You can begin receiving social security benefits as early as age 62. Still, the longer you wait, the higher your benefits will be. For example, if your full retirement age is 67 and you retire at age 66, you will receive 100% of your benefits. If you retire at age 70, you will receive 132% of your benefits.

The SSA has set the maximum age for social security benefits at 70. You cannot receive any additional benefits by delaying retirement past age 70.

It is important to note that the SSA does not automatically stop payments at age 70. If you continue to work and pay into the system, your benefits will increase. However, once you reach age 70, you will not receive any additional benefits regardless of how much you continue to work and pay into the system.

The maximum amount of monthly social security benefits

The maximum amount of monthly social security benefits that individuals can receive is determined by their lifetime earnings. For example, someone who has averaged $5,000 in monthly earnings over their working life would receive a maximum monthly benefit of $1,000. The maximum benefit amount is adjusted for inflation each year.

Maximum family social security benefits

The maximum family social security benefit is based on the earnings of the primary wage earner in the family. The more the primary wage earner earns, the higher the maximum family benefit.

The maximum family benefit is also affected by the number of children. The more children there are, the higher the maximum family benefit.

Maximum age to receive social security benefits

The Social Security Administration has set the maximum age to receive benefits at 70. This is because, after 70, workers are no longer accumulating new benefits. Also, life expectancy has increased over time, so the Social Security system needs to be sustainable for future generations.

The average life expectancy for someone born in 1900 was only 47 years, but for someone born in 1950, it was 70+ years. So, the maximum age for benefits was increased to ensure the system’s long-term sustainability.

Sign up

You may also like

All you need to know about Pure Strategy Nash Equilibrium

How to do a cash advance on a credit card?

Pros and Cons of Selling Feet Pics- A Comprehensive Guide

Make Money Online with Surveys for Free: Unlock Hidden Earning Potential