There is a difference between a money order and a cashier’s check. Let’s understand the concept with most asked Q&A.

If you reading this article it means you may have to deal with Money order or a cashier’s check. But don’t worry, we have covered all your queries. Well, there is a Difference between a Money Order and a Cashier’s Check. There are some key differences between them.

For example, a cashier’s check is usually issued with a bank while a money order can be purchased at almost any store. Another difference is in cost; cashier’s checks are usually more expensive than money orders.

Cashier’s checks also hold higher limits in general, but this isn’t always the case because there are also less expensive sources for money orders, too.

Let’s understand the definition of Money Order and Cashier’s check.

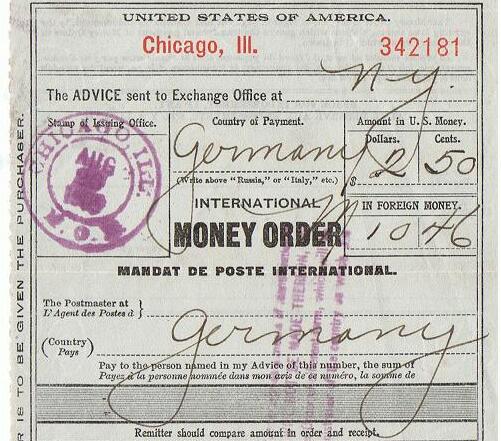

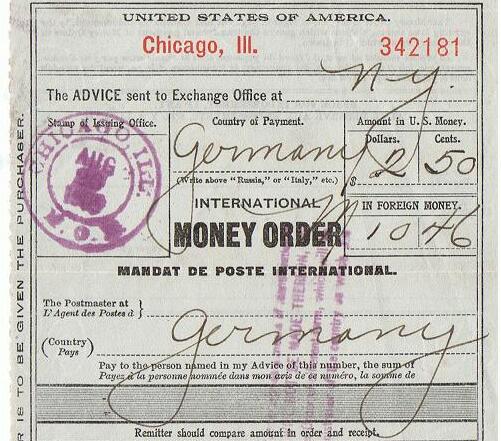

What is a money order?

A money order is a document that enables the recipient to receive a specified amount of money. The money order is typically purchased with cash or a debit card at a post office, bank, or other location that offers money order services. The money order can then be used to pay bills or send money to another person.

What is a cashier’s check?

A cashier’s check is a check issued by a bank. It is used like cash to pay for goods and services from any bank that honours cashier’s checks. They are often used in situations where a personal check would not be accepted, such as when buying a car or paying for a hotel room.

Is money order and cashier’s check the same?

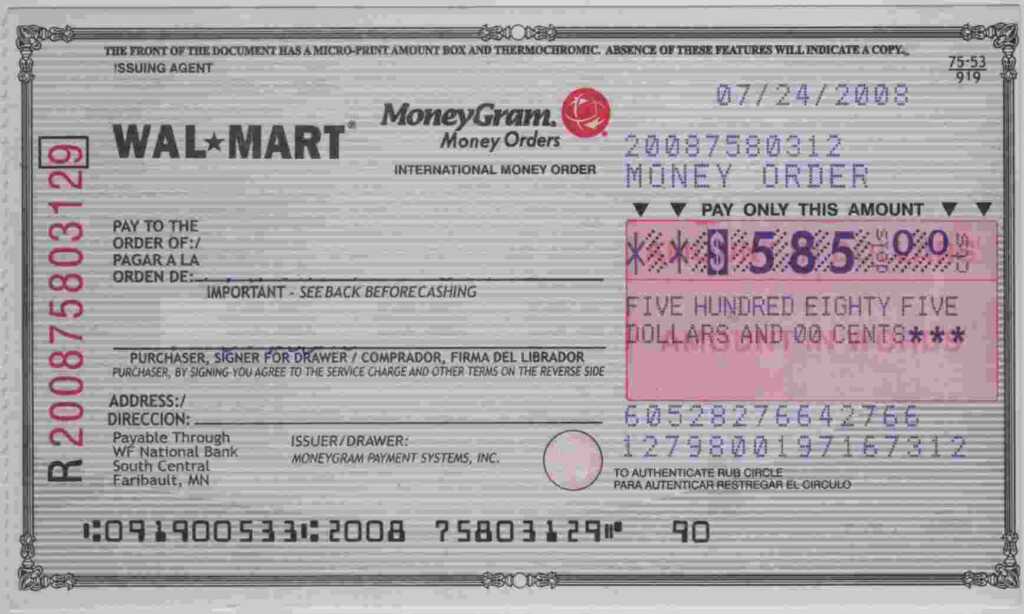

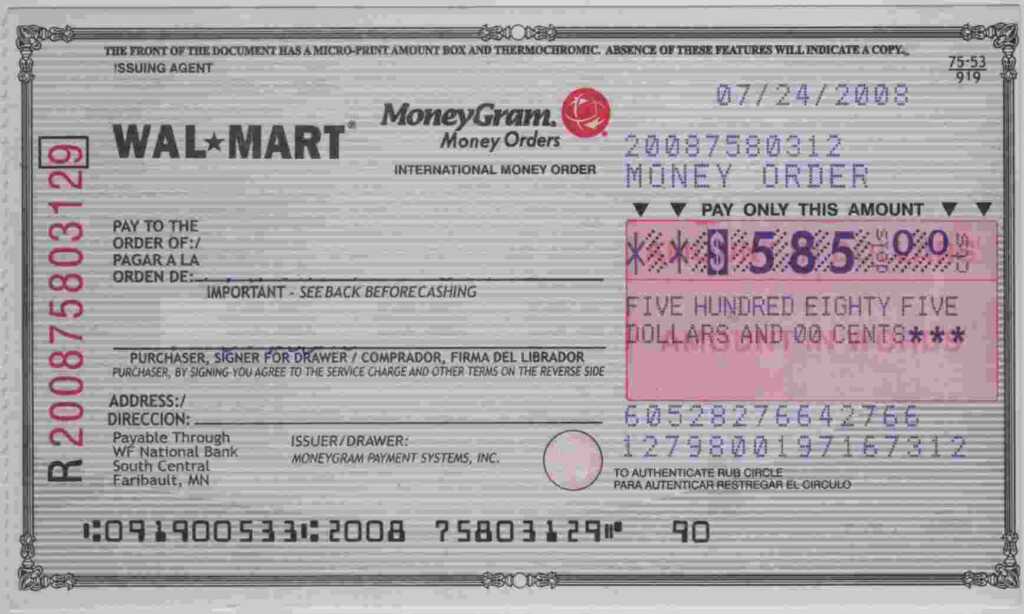

A cashier’s check is usually provided by the actual bank where you have an account. A cashier’s check is usually more expensive than a money order. A money order is just a piece of paper purchased at the post office or a store such as Wal-Mart or K-Mart.

The money order is not guaranteed. You have to confirm that the money order is good before using it.

Is a money order considered cash or check on a deposit slip?

A money order is a document, typically issued by a bank or post office, that allows the recipient to receive a specified amount of cash. The payee of the money order can then use the money order to make a purchase or deposit the money into a bank account.

When it comes to depositing slips, a money order is typically considered to be a form of a check. This is because the money order is a negotiable instrument, meaning that it can be used to pay for goods or services.

However, some banks may consider a money order to be cash, so it is always best to check with your bank to see what their policy is

Can I deposit a money order like a check?

Yes, you can deposit a money order like a check.You can cash a money order at a bank or credit union, or you can deposit it into your account. To deposit a money order, you’ll need to fill out a deposit slip and include the money order with your other checks and cash.

Is money order considered cash?

A money order is a type of payment order for a set amount of money. It is a written, prepaid order that is issued by a post office, bank, or other financial institution.

The payee is the person to whom the money order is made out. The payer is the person who purchases the money order and pays for it with cash or a check. While a money order is technically considered cash, it is not the same as cash in hand.

A money order is a negotiable instrument, meaning it can be transferred from one person to another. Cash, on the other hand, is a physical currency that cannot be transferred. Money orders are also a safer form of payment than cash, as they can be replaced if lost or stolen.

Is a money order certified funds?

A money order is a payment order for a pre-specified amount of money. Money orders are a type of certified funds. A money order is similar to a check, but it is not drawn on a bank account. Money orders are a convenient way to pay for small purchases or to send money to someone who does not have a bank account.

Also Read: 11 amazing Q&A: How Does TikTokers Make Money?

Is cashier’s check same as certified check?

A certified check is a check that has been certified by a bank as being genuine and backed by sufficient funds. A cashier’s check is a check that is issued by a bank and drawn on the bank’s funds. Both types of checks are considered to be very safe and secure, and they are often used for large or important transactions.

Is a cashier’s check safer than a money order?

There is no definitive answer to this question, as both cashier’s checks and money orders can be subject to fraud. However, some experts believe that cashier’s checks may be slightly safer than money orders, as they are typically less likely to be counterfeited and are more difficult to alter.

Additionally, cashier’s checks are typically backed by the issuing bank, while money orders are not. That said, it’s important to take precautions when using either type of payment, such as verifying the recipient’s identity and ensuring that the check or money order is properly endorsed.

Do cashier’s checks clear immediately?

No, cashier’s checks do not clear immediately. They are processed like any other check, which can take a few days. However, if you need the money right away, you can ask the issuer for a certified check, which will clear immediately.

3 types of Checks explained

Cashier’s Check

Bank

- Fund Source: Bank

- Guaranteed Payment: Yes

- Best For: Large Purchases

Certified Check

Bank

- Fund Source: Checking Account

- Guaranteed Payment: Yes

- Best For: Purchase under $1000.

Money Order

Bank + Other institutions

- Fund Source: Cash or Debit Card

- Guaranteed Payment: Yes

- Best For: Replacing cash payments.

Can I cash my own cashier’s check?

You can cash your own cashier’s check as long as you have the proper identification. Most banks will require you to show your driver’s license or another form of identification. You may also be asked to sign the back of the check.

What is the difference between certified check and money order?

A certified check is a check that has been guaranteed by the issuing bank. This means that the bank has verified that the check is valid and that the funds are available. A money order, on the other hand, is a piece of paper that represents a certain amount of money.

Money orders can be purchased at post offices, grocery stores, and other locations. They are often used to send money to people who do not have a bank account.

What is the maximum amount for a cashier’s check?

There is no maximum amount for a cashier’s check. However, the maximum amount that can be deposited into a bank account in a single day is $10,000. If you need to deposit more than that, you will need to do so over multiple days or use a different method, such as a wire transfer.

How long does it take for a money order to clear?

When you send a money order, the recipient will usually receive the funds within 1-3 business days. However, it can take up to 10 business days for the money order to clear. If you are sending a money order to someone who is in a different country, it can take up to 2 weeks for the money order to clear.

Why do banks hold cashier’s checks?

Banks are required to hold cashier’s checks for some time before they are processed, to make sure that the funds are available. This protects the bank and the person who is receiving the payment from any potential fraud.

Cashier’s checks are a convenient and safe way to make large or important payments. If you are ever in a situation where you need to make a payment and personal checks are not accepted, a cashier’s check may be the perfect solution.

Also Read: Can You Make Money with Turo? – Yes, You can!

Where can I get a cashier’s check or money order?

There are a few places you can get a cashier’s check or money order. The first place to check is your local bank or credit union. Many times, they will have this service available for their customers. If not, there are a few checks cashing places that will also issue cashier’s checks or money orders. Finally, you can always purchase one at the post office.

Can you get a money order at UPS?

Yes, you can get a money order at UPS. UPS offers money orders through MoneyGram, and you can purchase a money order at any UPS location. Money orders through UPS are a convenient way to send money, and you can use them to pay bills or send money to friends and family.

Can I get a cashier’s check at Walmart?

No. As Walmart is not a bank, it can not issue cashier’s check. However if you want a money order you can get one at Walmart. You will need to go to the customer service desk and ask for one. The process is usually quick and easy, and you can usually get your money order within a few minutes. There is usually a small fee for this service, but it is typically very reasonable.

Are money orders certified funds?

Yes, money orders are considered certified funds. This means that the funds are guaranteed by the issuing institution and are available for immediate withdrawal. Money orders are often used for large transactions or for those who do not have a bank account.

How much does a USPs money order cost?

A USPS money order costs $1.20 for the first $500 and $1.60 for each additional $500. There is also a fee for purchasing a money order with a credit or debit card.

Can I Mobile deposit a money order?

Yes, you can deposit a money order using your mobile device. To do so, simply take a picture of the money order and upload it to your bank’s mobile app. Once the money order has been deposited, you will be able to use the funds just like you would with any other deposit.

What is a money order limit?

A money order limit is a limit on the amount of money that can be sent using a money order. This limit is typically set by the money order issuer and may vary depending on the country of issuance.

For example, in the United States, the limit for money orders is typical $1,000, while in the United Kingdom, the limit is £500. Money orders are a popular way to send money internationally, as they are a safe and reliable form of payment.

How to cash a money order?

There are a few simple steps to cashing a money order. First, take the money order to a bank or credit union and present it to the teller. They will likely ask for your identification, so be sure to bring your driver’s license or another form of ID.

The teller will then cash the money order and give you the funds. You may also be able to cash a money order at a check-cashing store, but you may have to pay a fee for this service.

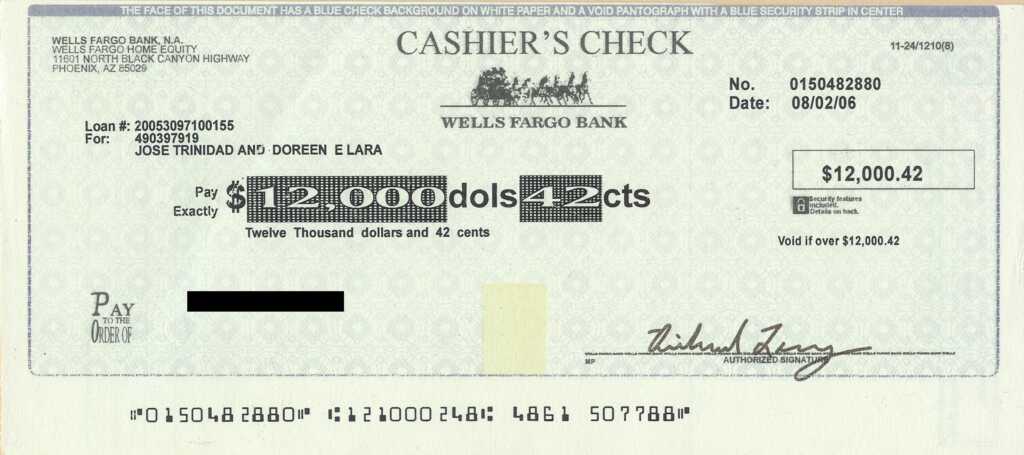

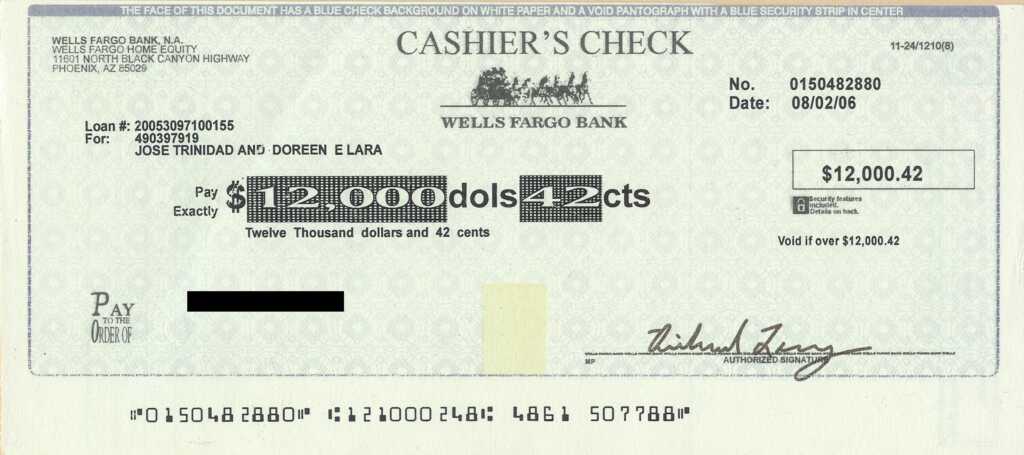

Cashier’s check vs. money order Wells Fargo

Wells Fargo is a bank that offers its customers a wide variety of banking services, including safe deposit boxes, checking, savings and other investment programs. They offer wire payment transfers, money orders and bill payments. The Wells Fargo website has full details of the services they offer their customers.

How much is a cashier’s check?

The cost of a cashier’s check varies depending on the bank and the amount of the check. Generally, banks charge a fee of around $10 for a cashier’s check. For example, if you need a cashier’s check for $1,000, the bank would charge a fee of $10.

Where to get a cashier’s check without a bank account?

There are a few ways to get a cashier’s check without a bank account. One way is to go to a check-cashing store and pay a small fee for the service. Another way is to ask a friend or family member to get the check for you.

Finally, you can go to a bank and ask for a cash advance on your credit card, which will give you the funds you need for the check.

Sign up

You may also like

All You Need To Know About 4PS OF MARKETING MIX

10 Amazing Ways To Make Money As A Kid

What is the difference between a subsidized and unsubsidized loan?

Can You Make Money with Turo? – Yes, You can!